Earlier this year, social media was abuzz with outrage at an announcement which was misinterpreted to mean that Woolworths was going to stop accepting cash in its stores – it was in fact Woolworths’ WCafés only that were going to stop accepting cash.

Trade Intelligence partnered with Chirp to run an online survey to find out how shoppers do and prefer to pay, and how they feel about a possibly cashless retail future.

More than 800 people responded, and below are four things we learned:

Firstly, it’s not an us vs them or cash vs digital issue – shoppers take a hybrid approach. On average, respondents use at least two different payment methods.

Three-quarters regularly pay with a debit or cheque card; two thirds regularly pay with cash. This links to how respondents prefer to pay, too.

42% say they prefer mostly card/digital but also some cash, with a further 27% saying they also prefer a combination of cash and card/digital, some of these with a slight preference for cash, some with an equal preference for both.

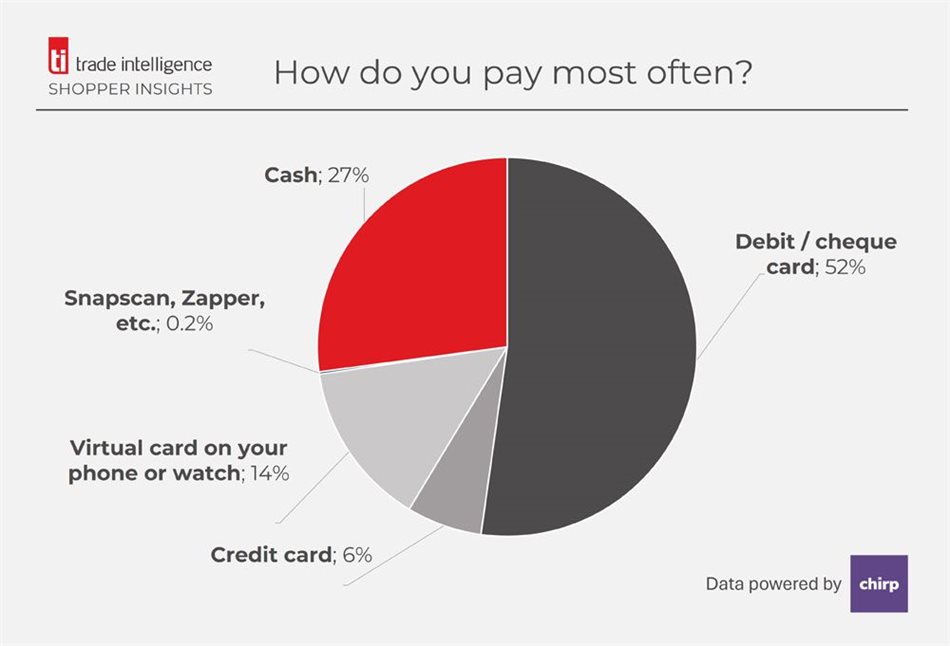

When pushed to disclose how they pay most often, for our shoppers, it’s debit/cheque cards for more than half, with cash a distant second (the main payment format for one in four).

Secondly, payment preferences are not 100% consistent across retailer types. The percentage of shoppers who say they prefer to use only a card/digital, or mostly a card/ digital, is between 62% (when shopping at supermarkets or cafés/fast food outlets) and the low to mid-70s (sit-down restaurants, general merchandise stores, clothing stores).

The percentage of people who prefer to spend ‘cash only’ is generally low, from 6% (or one in about 17 people) who say they prefer ‘cash only’ at clothing stores, to a high of one in five preferring ‘cash only’ for grocery shopping.

Thirdly, comfort with technology rises with income or creditworthiness. Those with credit cards are more likely to access them via a smartphone or watch than via the physical plastic card (definitely a ‘cool’ factor coming in to play when you can flash your watch at a terminal to pay for your kimchi quinoa salad…).

Remember, though, that fewer than 2% or one in 50 South African grocery shoppers, have a credit card, so with one in three of the sample having one, we are hearing from a small sub-set of creditworthy shoppers.

Nkosinathi Ndlovu 9 Jan 2024 Fourthly, fans of cash and card/digital payments appreciate each for fundamentally the same reasons: Safety and control over spending, although these mean different things in each context.

In terms of cash, the main perceived benefits are safety from fraud (e.g. card-cloning) and reducing the risk of overspending (spending limited to the amount of cash you’re carrying). In terms of card and digital payment methods, again safety is the most mentioned reason, but here it is safety in terms of not having to carry cash (less risk of being robbed) and control over spending in terms of payments generating a record of where and when money was spent (the ‘why’ is personal – credit cards don’t judge).

Fifthly (although it looks funny written out and is even harder to say), almost two out of three respondents are open to a cashless future. In fact, one in four is ‘awesome!-bring-it-on!’-excited about the prospect.

On the other end of the spectrum, 12% are specifically not excited. Interestingly, this number is higher for younger respondents than for older (to be honest, we expected parents to be less excited than kids), but openness rises with household income.

Image supplied

So, it seems the likes of WCafé, Gelato Mania, Uniq, OK Urban and the like are on the right track. Just as there will have been shoppers who were grumpy about the shift from cowrie shells as the prevailing form of ‘cash’ to the first coins, there will always be people who dig their heels in about change.

Already in other parts of the world shoppers can pay with the swipe of their palm (Amazon ‘just walk out technology’). Trade Intelligence keeps its finger on the pulse of South African FMCG retail - watch this space for free updates. No cash, cards, smart watches, cryptocurrency or cowrie shells required.

A note on the sample: The data was weighted to represent the South African online shoppers more accurately.