South Africa’s retail figures for November, including the Black Friday period were released recently by StatsSA. These insights may be a sneak preview into the state of December’s retail.

In real terms, retail sales for November decreased by nearly 1& YoY with the largest negative contributors being textiles, clothing and footwear (down 2%). A clear indicator that retail is feeling the effects of consumers' lack of disposable income.

With the December retail numbers only released later in February, Eighty20 has collated a retail roundup by tapping into two of its secondary data sources on their data portal. “Secondary datasets are a great way to augment financial and economic data to get a more comprehensive overview of consumer behaviour. These are also great sources for market share and competitor information,” says Andrew Fulton, director at Eighty20.

Eighty20’s research utilised both MAPS and BrandMapp datasets. MAPS data comprises of a quarterly, nationally representative survey of 20,000 people produced by the MRF. BrandMapp is an annual online survey of 35,000 people in households with incomes more than R10,000 per month. The findings highlighted by both datasets were released in December 2023.

The research highlights the number of people who say they shop at a certain store, or in a certain way and are not based on the value or frequency of visits to a particular store. In essence, the data refers to the number of people buying clothes, as an example, and not how much they may have spent.

Clothing consumers decrease

The MAPS dataset reveals that while there was some growth in consumers in 2022, in 2023 it was largely about contraction. Of particular interest is the large online clothing growth in 2022 (+58%) which reversed in 2023 (-17%).

Clothing bought in a store also decreased further from -9% in 2022 to -16% in 2023. One category that continued to grow was in-store cosmetics and beauty which grew by 13% in 2022 and 7% in 2023. Here, online sales bucked a similar trend (+17% to 2022, +5% to 2023). Looks like the ‘lipstick effect’ predicted by Eighty20 early last year has been evident in the retail environment.

Value brands are attracting customers

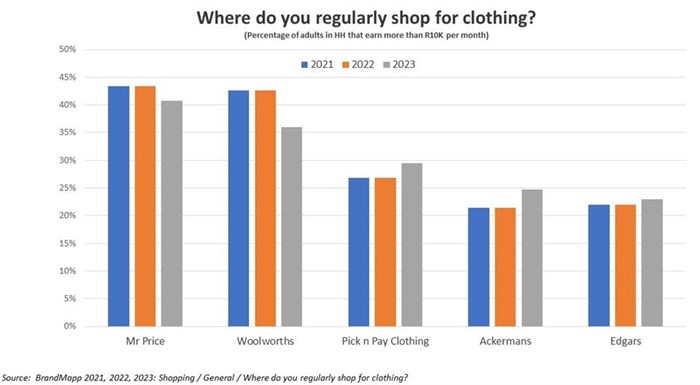

For the shopping insights, Eighty20 reviewed specific store brands using BrandMapp data to see how customers may be changing the stores at which they shop. Grocery brands like Checkers have been clear winners over the passed year while value clothing brands such as Pick ‘n Pay Clothing and Ackermans have been attracting customers:

Top brands: Clothing

BrandMapp data shows a notable shift in this category. While the data suggests Mr Price and Woolworths have lost higher income customers, the more value based offerings such as Pick ‘n Pay clothing, Ackermans, PEP and Jet have seen growth (in customer numbers if not in revenue).

Indeed, Pick ‘n Pay clothing (which opened 20 new stores in 2023) was one of the bright sparks in what has otherwise been one of the most challenging years in the grocer’s 57 years. Online clothing offerings have seen huge growth in recent years with 15% of high income consumers saying they now regularly shop at Shein, 13% at Superbalist and 8% at Takealot.

To put this in context, Shein now has more people saying they regularly shop there than the long standing brick and mortar retail brands Cotton On, Jet and Markham, with Superbalist just marginally behind those three stores.

Top brands: Beauty & Fragrances

The data also suggested a noticeable shift in where people shop for beauty products and fragrances. Clicks and Dischem are by far the biggest players in this space but have seen declines while Edgars has made a resurgence. Not many would have guessed that Retailability’s purchase of 114 Edgars stores in 2020 would have turned out to be prescient, but the data seems to suggest it.

Checkers, Shoprite and Takealot are also growing strongly in this category, suggesting a move from more expensive beauty and fragrances to value products that can be added to the monthly household shopping basket.

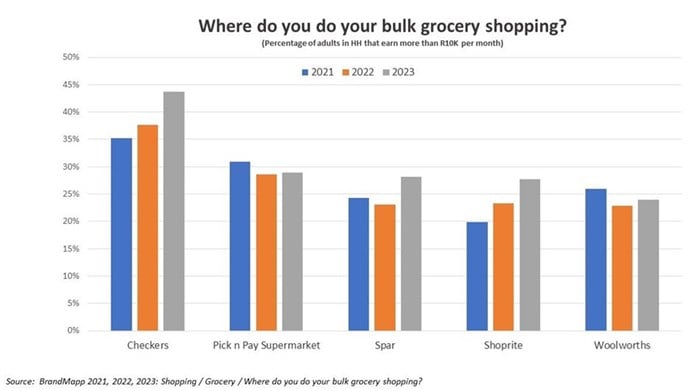

Top brands: Bulk grocery shopping

Shoprite and Checkers have enjoyed 16% and 19% growth in customers respectively in 2023, with Pick n Pay and Woolworths in a holding pattern.

Eighty20’s 2023 Q1 Credit Stress Report started showing how even the wealthy were starting to feel pitch early last year and this appears to be supported by retail sales at brands like Woolworths.

Consumers have shifted in droves to Shoprite and Checkers with their improved rewards programs, within the hour delivery and the perception of lower prices helping them to make great gains.

Top brands: Electronic goods

A comparable picture can be seen in shopping for electronic equipment or gadgets. While the biggest retailers, Takealot and Game have largely held their consumer numbers, the used goods offerings of stores like Cash Converters have seen their consumer volumes increase considerably as people search for bargains.

Richard Mukheibir, CEO of Cash Converters, confirms that this trend has been visible in their numbers.

“Consumers are under considerable pressure and actively rethinking the purchase of new goods. The rising trend of conscious buying of gently used, preloved goods is growing in popularity. We offer our customers quality products at around half the price you would expect to pay if purchased new, enabling customers to purchase top brands at affordable prices. The cash saving coupled with a 6-month guarantee gives customers further peace of mind,” concludes Mukheibir.