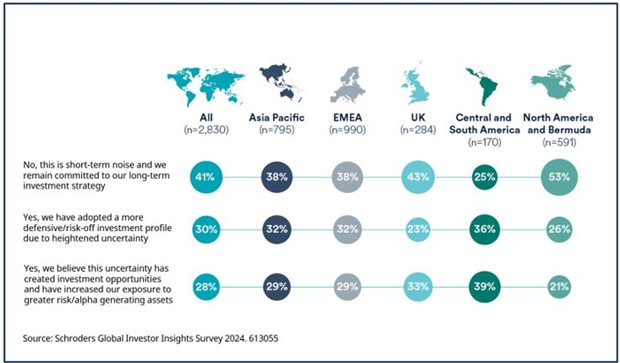

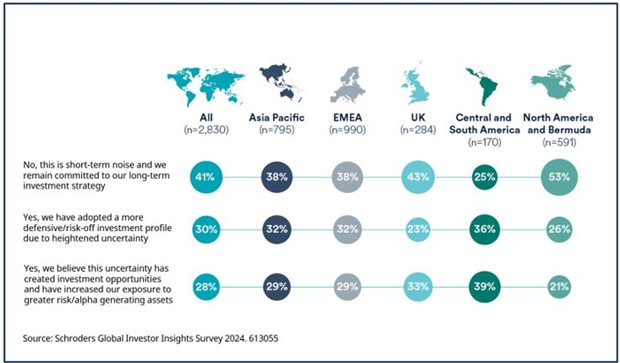

Global investors are looking through the short-term noise created by this year’s election cycle to harness the major trends of deglobalisation, disruption and decarbonisation by increasing their exposure to global equities and private equity, according to this year’s flagship Schroders Global Investor Insights Survey.

Source: Schroders Global Investor Insights Survey.

The landmark survey – which encompasses almost 3,000 investors and some $74.5tn in assets across the full spectrum of institutions – instead found that the impact of central-bank policy (70%), high interest rates (68%) and a potential economic downturn (62%) usurped any concerns about this year’s election cycle.

Specifically, in terms of national policymaking, investors said global alliances on politics and trade (44%), as well as high levels of government borrowing (35%), would most likely impact their investment positioning.

Source: Supplied.

Johanna Kyrklund, chief investment officer at Schroders, said: “As an active manager, it is vital to remain focused on investment fundamentals and not the newspaper headlines.

"Economic activity broadly remains positive and inflation has been moving in the right direction with major central banks now cutting rates. Lower interest rates are supportive of equity values.

“The most important election is still ahead of us with Americans heading to the polls next month. However, it is crucial to remember that politics tends to play out in months and years, rather than days and this is what we have remained focused on; keeping it simple.

“The results of this survey also clearly show the tension facing central banks and policy makers as almost as many respondents are as concerned about inflation risk as they are about high interest rates.

"Furthermore, high public-debt loads are a key concern in many major economies. Although private-sector balance sheets have generally come out of the Covid era in good shape, public balance sheets remain precarious. A key risk to be cognisant of is whether growing debt piles may eventually significantly destabilise bond markets.”

Top investment threats identified

Indeed, the study found that macroeconomic risks, such as higher than expected inflation or a slowdown in growth (62%), central bank policies (60%) and political risks (57%) were the biggest threats to fixed-income investing.

On the other hand, more than half (51%) of investors are expecting to increase their allocations to global equities over the coming two years.

Interestingly, almost half of all investors (44%) were looking to increase their allocations to active equities (44%), and demand for thematic equities (39%) was also high. Some 30% of institutional investors and gatekeepers said they are looking to increase their exposure to the energy transition as an investment theme.

Source: Supplied.

Specifically, they stated that the decarbonisation of portfolios, diversification (both 41%) and the ability to deliver returns (38%) were the biggest attractions to embracing the energy transition.

Alex Tedder, co-head of equities at Schroders, said: “It’s interesting to note that respondents are overall quite positive on the prospects for active managers. Equity markets this year have been dominated by a small number of companies.

"This has been a global trend, but has been particularly pronounced in the US, with the technology and AI phenomenon very powerful in that market. Since July, we’ve had a reassessment amid changing interest-rate expectations.

“It may be time to look at areas that have been out of favour and have become attractive from a valuation standpoint. Certain sectors such as utilities, REITs, biotechnology and alternative energy are potentially more interesting in this environment of lower inflation and interest rates.

"This is the type of situation where active managers can be nimble in allocating earlier to those parts of the market that we think will be the future winners.”

Private markets driving growth

Investment in private markets continues to grow with over 80% of investors already investing in private markets or have plans to do so in the near term. It is now regarded as a core component of portfolio construction across both institutional and wealth investors.

Key reasons for allocating to private markets include both higher returns and greater portfolio diversification. More than half (53%) of all respondents wish to increase allocations to private equity in the next 12 months, followed by 42% in private debt and 45% in renewable infrastructure equity.

This is also seen as a key route through which investors can harness the energy transition, the decarbonisation shift and the technological revolution.

Source: Supplied.

Georg Wunderlin, chief executive officer of Schroders Capital, said: “Private markets are an essential source of creative and long-term capital to finance fundamental structural shifts in our societies – driven by decarbonisation, deglobalisation, demographics and the AI revolution. Investors are recognising the potential of private assets to drive positive change, and, therefore, higher returns.

“In addition, private assets are valued as a source of diversification. Following shifts in the rate environment, private market investments are at a pivotal moment. What is required in the future is even deeper skills of managers to source, execute and manage private assets. Consequently, investors must be increasingly selective and partner with managers who possess the ability to control value creation.

“It is crucial to enable not only institutional but also individual investors to profit from the benefits of private market investments. Accessibility of private asset classes has improved significantly in recent years on the back of a much greater array of fund structures aimed at individual investors. We see it as a key mission for us to continue to drive this trend."