Realme, a rapidly expanding Chinese smartphone brand that began life as an Oppo sub-brand for the Indian market, has officially made its debut in the fiercely competitive South African smartphone market. The company snuck into the country midway through 2023 and has sold over 20,000 devices in the budget segment.

Gareth Clarke, Realme South Africa account lead, addresses the crowd at the Cape Town launch event.

“We aim to be another credible option for customers. By credible, I’m referring to the feature sets – the large camera, the ample storage, the ultra-fast charging. And I believe the design also distinguishes us from the competition,” Gareth Clarke, Realme South Africa account lead, told Bizcommunity at the Cape Town leg of the brand’s launch tour.

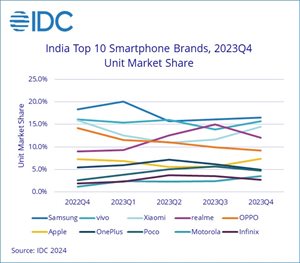

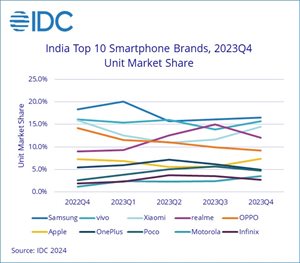

Realme’s goal is to offer an attractive alternative for South African consumers in search of dependable smartphones with sought-after features – an approach which helped it reach a Q3 2023 peak at 15% market share in India, second only to Samsung.

Focus on traditional retail

The brand’s initial focus is on traditional retail outlets such as Truworths and TFG, where the company has found success in these stores, particularly with its C-series and Note 50 devices.

The Realme Note 50 is the volume seller

With a strong presence in these retailers, Realme is capitalising on the South African market’s dependence on credit-based purchases. The retail market is driven by account purchases, a trend exacerbated by the rapid growth of buy-now-pay-later (BNPL) in online ecommerce.

“South Africa as a market is still very retail driven. If you’re looking to achieve large volumes, it’s still very much retail driven,” Clarke explains.

This approach aligns with the company’s primary focus on traditional retail outlets and utilising credit options to cater to local purchasing preferences.

Competing and collaborating with Oppo

While Realme operates as a separate brand, the company recognises synergies with its parent company, Oppo.

India’s smartphone market grew by 1% YoY in 2023 to 146m units, says IDC

These synergies, which include logistics and resource sharing, help to keep costs low – a benefit that is passed on to consumers. Realme stresses that its competition with Oppo is confined to the mid-range and upper-entry segments, contributing to a dynamic market.

As Clarke puts it, “competition is always good. It’s always beneficial to, as I say, throw the cat amongst the pigeons.”

While the brand acknowledges the logistical advantages provided by its synergy with Oppo, it maintains a distinct identity in its customer-facing operations.