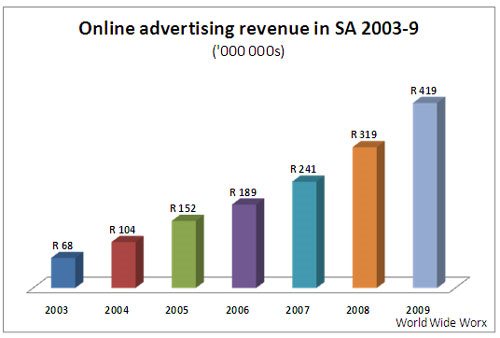

The findings indicate an encouraging 32% growth in online advertising in 2008, after an equally positive 27% growth in 2007. Actual online advertising spend in 2008 was up to R319-million, from R240-million the year before. The figures contrast strongly with the statistics from Nielsens but are based on actual revenue figures derived directly from publishers, and not rate card rates. However, neither Nielsen's nor the commissioned study were able to obtain data from Google, which would further increase the figure significantly.

This robust growth is indicative of growing confidence in the online medium.

Adrian Hewlett, Chairperson of the OPA, highlights three key trends behind this growth: “Increased awareness of the inherent potential of online advertising has resulted in a growing pool of online advertisers. The net result is that even if certain long term online spenders reduce some of their digital budget in 2009, the arrival of many new players will fuel exponential growth for the industry.

"Secondly, and complementary to this trend is that there has been a considerable boost in digital adoption by traditional media buying and creative agencies, as well as new specialist agencies. Previously publishers saw only 20% of their spend coming from agencies. In the last 12 months this has increased to 45%, and in 2009 we expect this to shift even further, with perhaps as much as 60% coming from agencies.”

Finally, additional publishers have entered the market, further promoting the online proposition and maturing the online advertising market.

Online set to surpass Cinema

With a positive growth rate of 32% forecast for 2009, versus a negligible growth rate for cinema, the study asserts that online will surpass cinema spend in 2009. “While online economics in South Africa are different to those of traditional commerce, there is little doubt that a recession in the physical world would make itself felt in the online environment, but the 2009 expectation shows how robust this sector remains,” says Arthur Goldstuck, MD of World Wide Worx. This significant development will further encourage traditional buying agencies to embrace the online medium.

An international comparative

The study revealed that the only mature Internet market where online advertising appears to be growing faster than South Africa is Brazil, which is expecting 45% growth for 2008, after recording the same growth rate in 2007. In the English-speaking world, where the USA, UK, Canada and Australia outpaced South Africa in 2006 and 2007, all fell below the 30% growth mark in 2008, with the USA falling as low as 11% and the UK falling to 22%. Growth for both of these is expected to be below 10% in 2009. Comparatively however this growth will still appear healthy when compared to other major media.

Rich media (interactive HTML banners) and the static banner share top position for revenue generating advertising in South Africa, whilst the increase of sponsorships for online categories indicates a move by publishers to leverage brand association as much as traffic. The top five sectors from which advertising revenue is drawn include Finance, Insurance, Automotive, Technology and Telecommunications. This is a powerful reflection that purchase decisions for these sectors are first researched on the internet.

The publisher's perspective

Online strategy has also evolved significantly in South Africa: building a more profitable web site has become the single most important core strategy for online publishers. In a 2006 edition of this study it ranked third, when it was important but not critical.

As in 2006, publishers still believe that the measurability and the demonstrable returns of online advertising are the most important benefits to advertisers. However, the key obstacles to online advertising remains lack of knowledge by advertisers and by agencies, followed by lack of interest by both of these parties. “It is fascinating to note that these factors were ranked in the exact same order as in 2006, with lack of knowledge by advertisers and ad agencies increasing in significance,” says Goldstuck. “It would have been expected that, three years on, these would no longer be such important issues for online advertising, yet they remain critical obstacles.” This critical issue is one which the OPA will continue to address, with workshops, and direct one on one meetings with traditional media agencies and through creative agencies.

Online publishers do not see new media formats as a threat: they are almost unanimous that Social Media and Social Networking are a great opportunity, along with video sharing, reader-generated content, and citizen journalism.

Conclusion

“The Online Media in South Africa 2009 study reveals a maturing industry on a strong growth curve. There are obstacles which the industry as a whole need to address, but the forecast for 2009 is strong' concludes Adrian Hewlett, OPA chairperson.

For more information please contact Theresa Vitale on 011 454 3534, or email her on .

World Wide Worx: Arthur Goldstuck: e-mail ; tel. 011 782 7003.